Details

Overview

General Overview

1. Company General Information

Company Name: RICH RENT SRL

Holding Structure: TOT Capital Holding – Cayman Islands / Luxembourg / Dubai

Tax Regime: 0% (holding level), international tax optimization

Financial Operations: fast international transfers, crypto acceptance

Analysis Period: 10 years

Business Activity:

Real estate leasing

Property management

Maintenance and related services

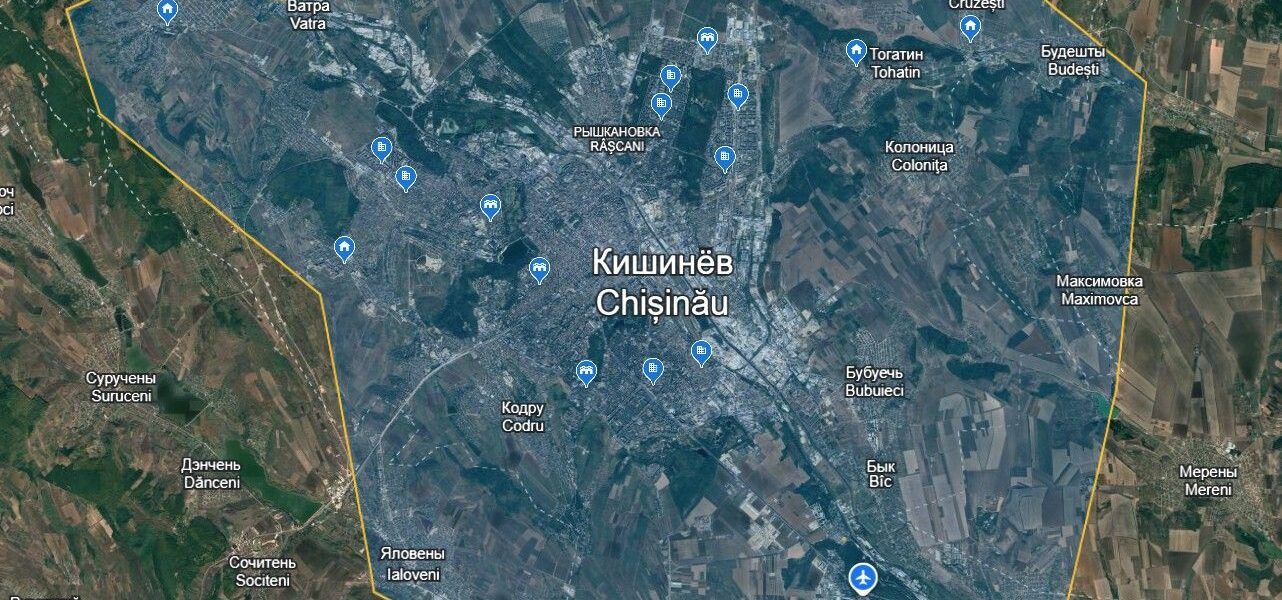

2. Operating Areas

Houses (duplex / terraced) – Chișinău suburbs:

Cruzești

Băcioi

Trușeni

Townhouses – Premium locations in Chișinău:

Botanica

Rîșcani

Buiucani

Ciocana

Townhouses are located in high-demand urban areas, targeting premium tenants such as expatriates, executives, and high-income families.

Apartments (8 units) – Chișinău:

Botanica

Rîșcani

Buiucani

Ciocana

Townhouse Investment (Chișinău)

Base Parameters

Property type: Individual / terraced townhouse

Average size: 150–180 sqm

Private yard / parking

Premium finishes

Purchase price per unit: €350,000

Annual asset appreciation: 6–10%

Analyzed Scenario

Number of units: 4 (one per sector)

Total investment: 4 × €350,000 = €1,400,000

Rental Income

Minimum rent: €1,800 / month

Maximum rent: €2,500 / month

Average estimated rent: €2,150 / month

Annual income:

Per unit: €25,800

Total (4 units): €103,200

Maintenance Costs

Standard Package: €250 / month / unit → €12,000 / year

Rich Package: €800 / month / unit → €38,400 / year

Profit & ROI – Townhouses

| Scenario | Gross Income | Costs | Estimated Net Profit* | ROI |

|---|---|---|---|---|

| Standard | €103,200 | €12,000 | ≈ €114,000 | ≈ 8.1% |

| Rich | €103,200 | €38,400 | ≈ €141,600 | ≈ 10.1% |

*After services, before full tax optimization.

Investment Recovery

Standard: ~12.3 years

Rich: ~9.9 years

With asset appreciation of 6–10% annually, property value can double within 8–10 years.

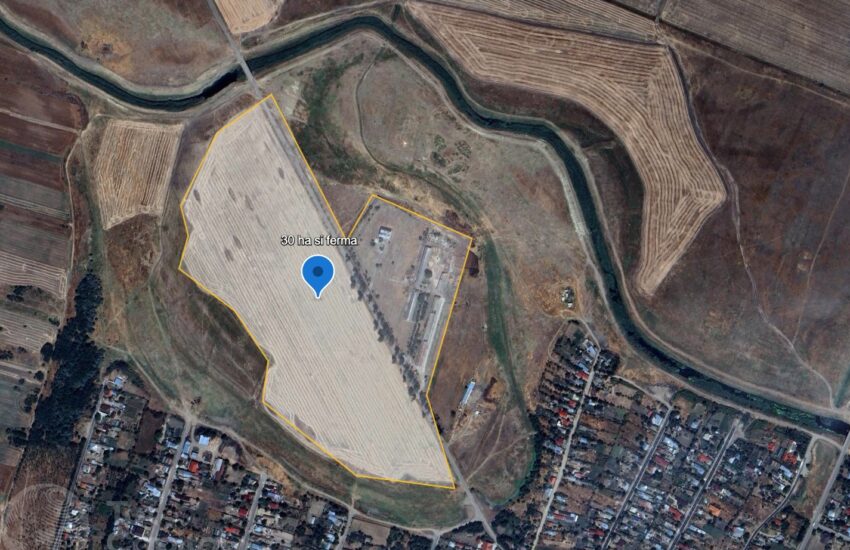

Houses Investment (6 units – Suburbs)

Base Parameters

Average size: 130 sqm

Average cost per unit: €220,000

Cost per sqm: ≈ €1,700

Total investment: 6 × €220,000 = €1,320,000

Annual appreciation: 4–8%

Rental Income

Minimum rent: €1,000 / month

Maximum rent: €1,500 / month

Average rent: €1,250 / month

Annual income:

Per unit: €15,000

Total (6 units): €90,000

Maintenance Costs

Standard: €200 / month / house → €14,400 / year

Rich: €700 / month / house → €50,400 / year

Profit & ROI – Houses

| Scenario | Gross Income | Costs | Estimated Net Profit* | ROI |

|---|---|---|---|---|

| Standard | €90,000 | €14,400 | ≈ €104,400 | ≈ 8% |

| Rich | €90,000 | €50,400 | ≈ €140,400 | ≈ 10.6% |

*After services, before full tax optimization.

Investment Recovery

Standard: ~12.6 years

Rich: ~9.4 years

Apartments Investment (8 units)

Investment Structure

4 one-bedroom apartments (40 sqm): €320,000

4 two-bedroom apartments (55 sqm): €440,000

Total investment: €760,000

Annual appreciation: 6–10%

Rental Income

| Type | Avg. Rent | Annual Income / Unit | Total |

|---|---|---|---|

| 1-bedroom | €600 | €7,200 | €28,800 |

| 2-bedroom | €1,100 | €13,200 | €52,800 |

| Total | €81,600 |

Maintenance Costs

Standard: €9,600 / year

Rich: €38,400 / year

Estimated Profit

| Scenario | Gross Income | Costs | Estimated Net Profit* |

|---|---|---|---|

| Standard | €81,600 | €9,600 | ≈ €91,200 |

| Rich | €81,600 | €38,400 | ≈ €120,000 |

3. Total Investments & Key Indicators

Total Investments

Duplex / terraced houses (suburbs): €1,320,000

Apartments: €760,000

Townhouses (Chișinău): €1,400,000

TOTAL INVESTMENT

👉 €3,480,000

Estimated Annual Income

Suburban houses: ≈ €104,400 – €140,400

Apartments: ≈ €91,200 – €120,000

Townhouses: ≈ €114,000 – €141,600

👉 TOTAL ANNUAL INCOME:

≈ €309,000 – €402,000

Key Indicators

Average ROI: 9.5 – 11%

Asset appreciation: 5–10% annually

Investment recovery: 7–10 years

Positive cash flow from year one

Portfolio mix: premium + mass market (balanced)

4. Secondary Services & RICH RENT Ecosystem

Developed internally or via partnerships (%):

Mobile application: €8,000

Micro-lending:

Capital: €1,000,000

Interest rate: 18% annually

Cleaning company (SRL),Construction & renovation company (SRL)

Audit, accounting & legal services

Call Center

Partnerships: 10–20% commission

Car rental / Taxi ” RICH Rent Car” srl

Tourism & airline ticketing ” RICH Fly” SRL

IT & AI company

Sponsorship & advertising (%)

5. External Property Management

Commission: 20% of monthly rent

Services included:

Marketing & tenant management

Rent collection

Contracts & legal relations

Cleaning & maintenance

Rich packages (full-service management)

6. Conclusions & Outlook

✅ Stable, scalable, and profitable business

✅ Positive cash flow from the first year

✅ Integrated ecosystem that self-sustains

✅ High expansion potential: Romania – Ukraine – EU – Dubai

✅ Possibility of banking & investment partnerships

✅ Potential listing on international stock exchanges